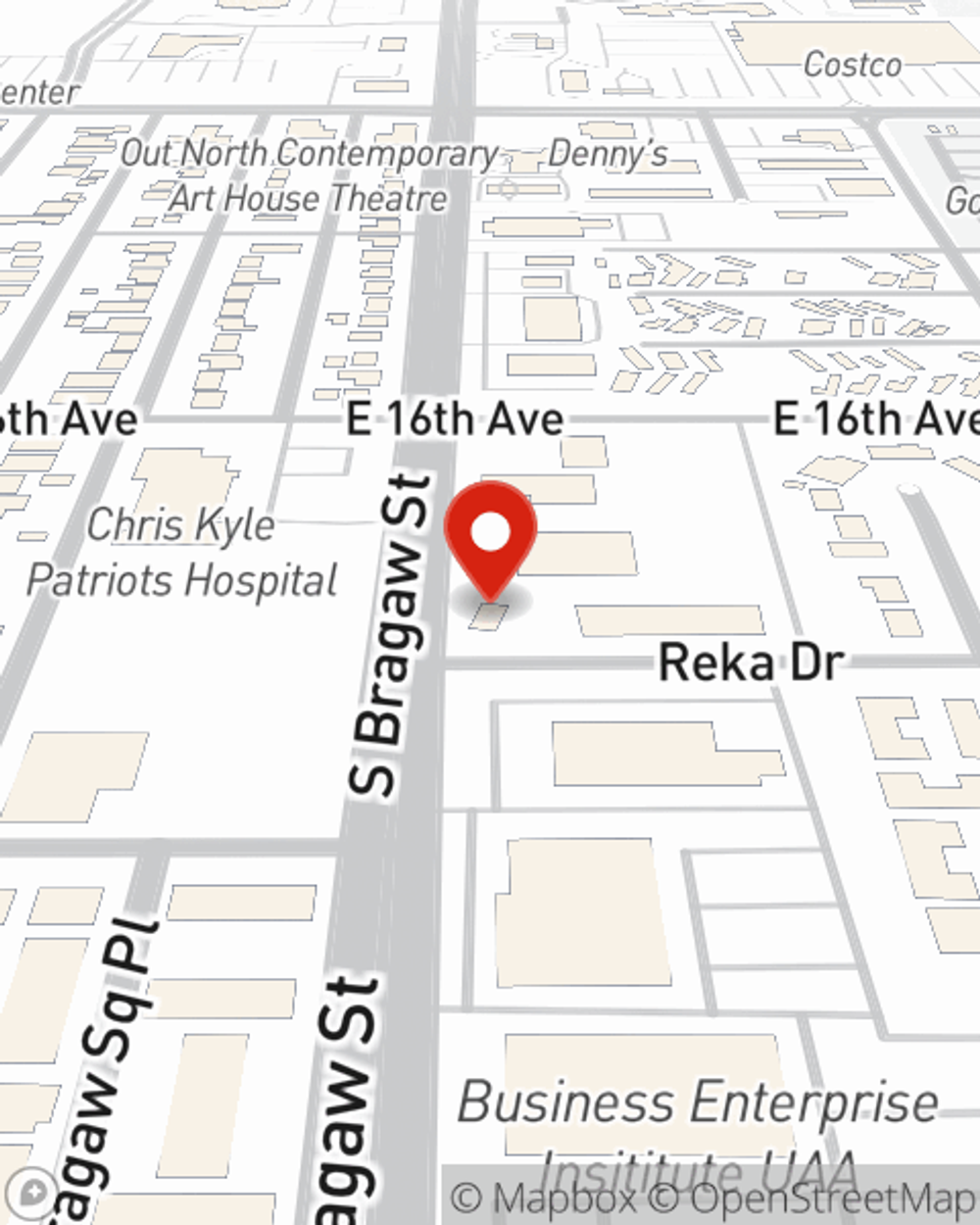

Condo Insurance in and around Anchorage

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Your Search For Condo Insurance Ends With State Farm

Investing in condo ownership is a big responsibility. You need to consider needed repairs location and more. But once you find the perfect unit to call home, you also need dependable insurance. Finding the right coverage can help your Anchorage unit be a sweet place to call home!

Here's why you need condo unitowners insurance

Quality coverage for your condo and belongings inside

Put Those Worries To Rest

Things do happen. Whether damage from weight of ice, smoke, or other causes, State Farm has terrific options to help you protect your condominium and personal property inside against unanticipated circumstances. Agent Doug McCann would love to help you generate a plan that is personalized to your needs.

Anchorage condo owners, are you ready to find out what a company that helps customers by handling thousands of claims each day can do for you? Visit State Farm Agent Doug McCann today.

Have More Questions About Condo Unitowners Insurance?

Call Doug at (907) 333-6575 or visit our FAQ page.